can i get a mortgage if i owe back taxes canada

Having tax debt also called back taxes wont keep you from qualifying for a mortgage. Consider communicating clearly with Internal Revenue Service agents and resolving a payment plan issue.

How To Make Your Home Mortgage Tax Deductible In Canada Youtube

Borrowers with delinquent Federal Tax Debt are ineligible.

. Check Your Eligibility for Free. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. You MUST make THREE.

You can get a reverse mortgage directly from HomeEquity Bank or through mortgage brokers. What FHA guidelines say about qualifying for a mortgage when you owe federal tax debt. Can I get a mortgage with a state tax lien.

The market subsequently flattens and the list price is now 800000 so you. There are certain conditions that youll need to meet in order to get approved however so lets take a look at those. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having. Higher TDS means you are potentially becoming more indebted than you can afford so taking on more debt is likely. It is possible to be approved for a VA loan or an FHA loan if you owe back taxes.

If youre not ready to give up on the house of your dreams call SH. However there are some stipulations and guidelines that you should be aware of in order to safeguard your eligibility with a lender. The long answer is that whether you will get the mortgage has less to do with the IRS and more to do with your lenders guidelines.

Equitable Bank offers a reverse mortgage in some major urban centres. Check Your Eligibility Today. To find out how much tax-free cash you could qualify for with a reverse mortgage call us now at 1-866-522-2447 or get your free reverse mortgage estimate now.

Lock In Your Rate With Award-Winning Quicken Loans. Get the Best Rates. To learn more schedule a free consultation today by calling 410-793-1231 or using the quick contact form on.

Can I get a mortgage if I owe federal tax debt to the IRS. Can You Get A Mortgage With Debt In Canada. In HUD 40001 the FHA loan handbook we learn the following about the FHA stance on borrowers who owe back taxes starting with a look at the issue of tax delinquency.

In short yes. It is a loan and you must be 62. When tax liens are involved it can make the process a stressful one.

HomeEquity Bank offers the Canadian Home Income Plan CHIP which is available across Canada. Causes of a mortgage shortfall. We have decades of experience helping people like you resolve tax issues.

Find Out If You Qualify Now. You bought at the peak with a high-ratio mortgage and the market dropped. Call the IRS and set up a repayment plan with them.

Ad 2022 Latest Homeowners Relief Program. The good news is that you still can. Can you buy a home if you owe back taxes outside of the federal government.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Two financial institutions offer reverse mortgages in Canada. You may find this is true for both state and federal taxes but FHA loan rules concentrate on federal taxes.

Ad Try Our 2-Step Reverse Mortgage Calculator. And chart your set of Dos and Donts for your reverse mortgage. If possible pay off any tax debt or liens before you submit your mortgage loan application or show proof that you have been working to pay off your back taxes by making.

Ad Get a Free Quote Now with No Obligation. In short yes you can. Check If You Qualify For 3708 StimuIus Check.

So can you get a mortgage if you owe back taxes to the IRS. In general your likelihood of being approved for a home loan varies based on your individual circumstances but any type of debt added to your borrower profile can make you a. For example you bought a condo or a house for lets say a million dollars with 10 down.

Our 4 step plan will help you get a home loan to buy or refinance a property. The payment plan improves lenders confidence and increases your chances of becoming a homeowner. Their varied experiences can help you see how others are enjoying the benefit of accessing their homes equity.

If you owe back taxes you may still be approved for a VA home loan if you meet the following conditions. If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost. If you owe other kinds of taxes like property tax or state tax you might still be able to get approved for a mortgage.

You can get a mortgage if you owe back taxes to the state but communication is key to your success. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an affordable rate. Even if your TDS ratio is slightly higher you might still qualify for a mortgage based on your total debt load.

Other debts you may owe to the IRS may include monthly tax payments. Put another way you have negative equity in your home.

How To Become A Mortgage Lender For Your Children The Washington Post

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv

John Alan Cohan On Twitter Tax Attorney Debt Relief Programs Debt Relief

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

/how-many-mortgage-payments-can-i-miss-foreclosure.asp-V1-3e102eda72844d3d86f313001f6c2b73.jpg)

How Many Mortgage Payments Can I Miss Pre Foreclosure

Reverse Mortgages And Taxes Retirement Living 2021

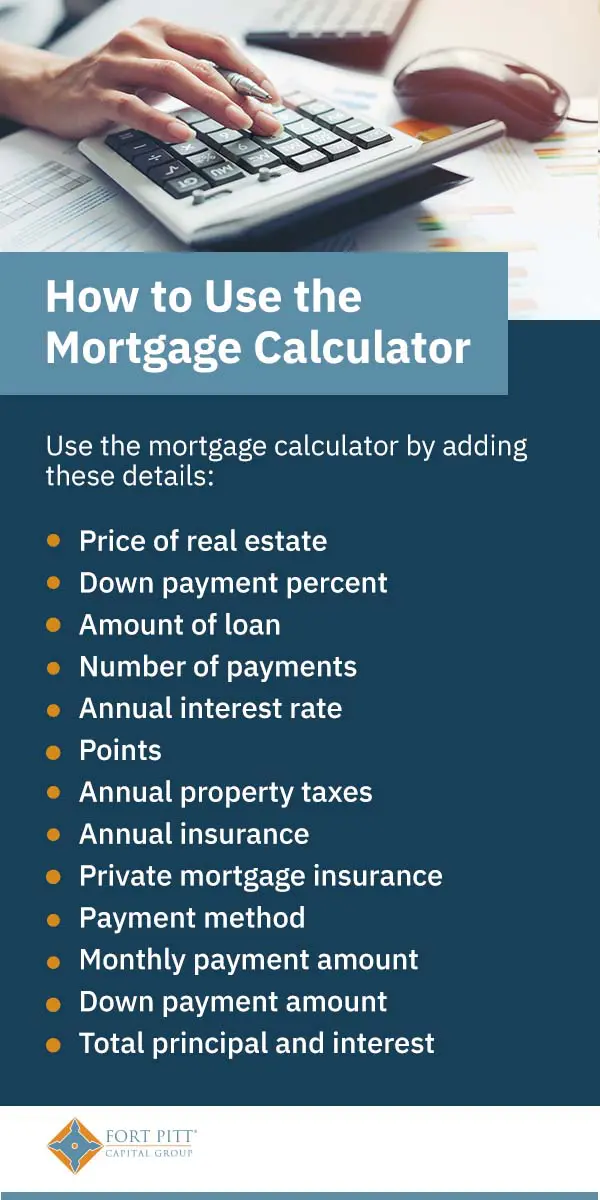

Mortgage Calculator Estimate Your Monthly Payments

So You Owe The Irs Bummer Here S How To Plan Better For Next Year Irs Taxes Property Tax Tax

Can You Rent Your House If You Have A Reverse Mortgage

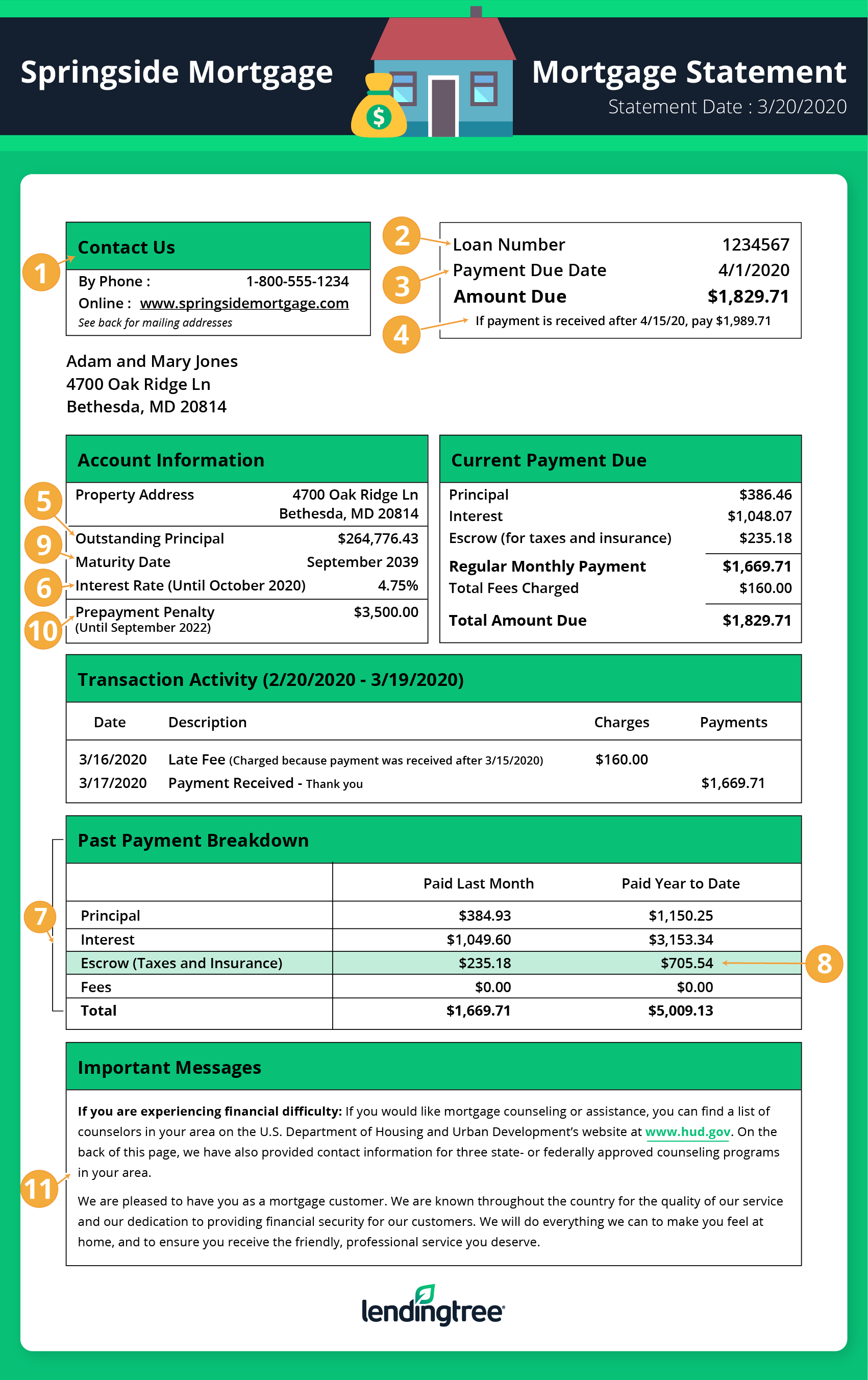

How To Read A Monthly Mortgage Statement Lendingtree

Relative Clauses Relative Pronouns Sentences

How Does Co Signing A Mortgage Impact Your Personal Taxes

Your 2020 Guide To Tax Deductions The Motley Fool

How To Make Your Home Mortgage Tax Deductible In Canada Youtube

Pin On Financing Mortgages Refi

Millions Of Americans Won T See Their Tax Refunds For Months Time

Reasons To Buy A New Home In Winter Video Tax Refund Home Buying New Homes